All Categories

Featured

In 2020, an approximated 13.6 million united state families are approved financiers. These houses regulate enormous wealth, estimated at over $73 trillion, which represents over 76% of all personal wide range in the U.S. These financiers take part in financial investment opportunities normally inaccessible to non-accredited investors, such as investments in personal companies and offerings by specific hedge funds, personal equity funds, and venture resources funds, which permit them to grow their riches.

Continue reading for information about the most current recognized investor alterations. Capital is the gas that runs the economic engine of any kind of country. Financial institutions generally money the bulk, however hardly ever all, of the funding required of any type of procurement. After that there are situations like startups, where financial institutions don't provide any financing in all, as they are unproven and considered risky, but the need for resources stays.

There are largely two rules that permit issuers of safeties to supply endless amounts of safety and securities to investors. equity investor leads. Among them is Policy 506(b) of Guideline D, which allows a provider to offer safety and securities to endless accredited financiers and as much as 35 Innovative Capitalists just if the offering is NOT made through basic solicitation and basic marketing

The recently taken on modifications for the very first time accredit specific financiers based on financial sophistication demands. A number of various other changes made to Regulation 215 and Regulation 114 A clear up and broaden the listing of entity types that can certify as an approved capitalist. Below are a couple of highlights. The modifications to the recognized capitalist meaning in Guideline 501(a): consist of as certified financiers any kind of trust fund, with complete possessions a lot more than $5 million, not developed specifically to purchase the subject safeties, whose purchase is directed by a sophisticated person, or consist of as accredited financiers any kind of entity in which all the equity owners are certified investors.

There are a number of registration exceptions that eventually expand the cosmos of potential financiers. Numerous exemptions require that the financial investment offering be made just to persons that are approved investors (qualified investment).

Additionally, recognized capitalists often obtain a lot more desirable terms and higher potential returns than what is available to the general public. This is due to the fact that private positionings and hedge funds are not needed to conform with the exact same regulative demands as public offerings, enabling more versatility in terms of investment approaches and possible returns.

Investor Individual

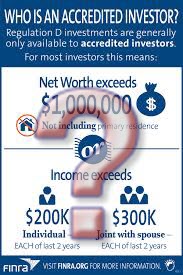

One factor these safety offerings are restricted to certified investors is to make certain that all participating capitalists are economically advanced and able to fend for themselves or maintain the danger of loss, therefore providing unnecessary the securities that come from an authorized offering.

The net worth test is fairly easy. Either you have a million bucks, or you don't. On the earnings test, the individual needs to satisfy the thresholds for the 3 years regularly either alone or with a partner, and can not, for example, satisfy one year based on private earnings and the following two years based on joint revenue with a partner.

Latest Posts

Tax Sale Overages List

Tax Delinquent Property Sales

Tax Forfeited Land